Smell-Proof Storage: Complete Cannabis Storage Systems

Smell-Proof Storage Solutions: Complete Cannabis Storage Systems Guide

Effective smell-proof storage represents essential accessory category for cannabis consumers managing discretion, preserving flower freshness, and complying with transportation regulations - yet many dispensaries treat storage as afterthought commodity category missing significant revenue and customer service opportunities. Understanding odor-containment technology, material specifications, humidity control integration, and complete storage system merchandising helps dispensaries capture high-margin accessory sales while providing genuine value solving customer storage challenges beyond basic functionality.

This comprehensive storage systems guide examines smell-proof container types from budget bags to premium glass jars, analyzes odor-blocking technology and effectiveness variations, integrates humidity control for quality preservation, and provides merchandising strategies positioning storage as essential component of complete cannabis consumption systems rather than optional accessories. Whether customers ask about discrete transport, long-term storage, or freshness preservation, this guide equips dispensaries to recommend optimal solutions driving both satisfaction and profitability.

Odor Containment Fundamentals: How Smell-Proof Technology Works

Understanding odor containment mechanics helps dispensaries evaluate product claims and educate customers about effectiveness differences across storage options.

Activated Carbon Lining Technology: Premium smell-proof products incorporate activated carbon fabric layers absorbing odor molecules attempting to permeate container walls or escape through sealing points. Activated carbon's massive surface area (1 gram can have 500+ square meters surface area) traps scent compounds preventing detection. However, carbon effectiveness degrades over time as absorption capacity fills - expect 6-12 month effective lifespan for carbon-lined bags and pouches with daily use. Products claiming "lifetime" smell-proof performance using carbon technology overstate effectiveness - carbon eventually saturates requiring replacement for continued performance.

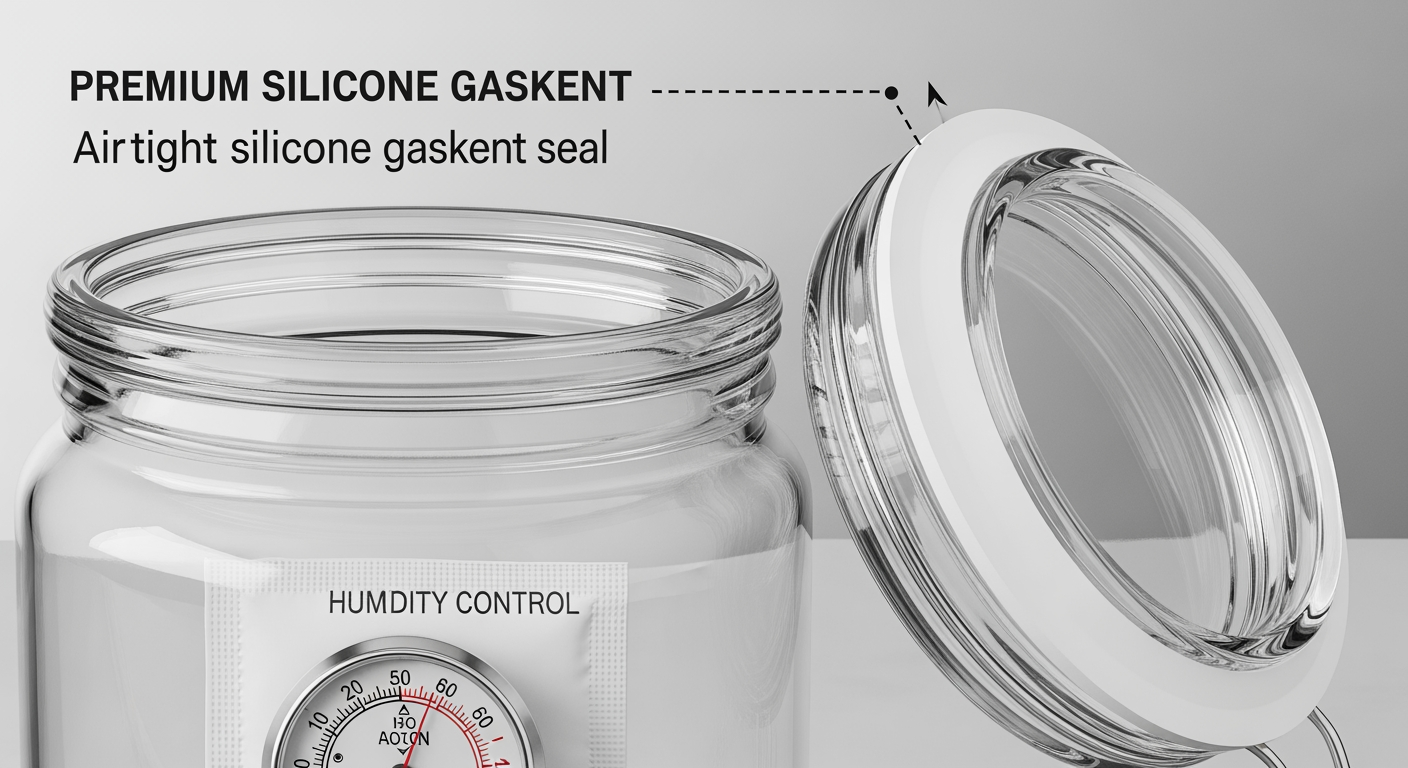

Airtight Sealing Mechanisms: True odor containment requires preventing air exchange between container interior and environment. High-quality sealing uses silicone gaskets, compression locks, or vacuum sealing creating barriers preventing molecular migration. Budget containers using simple friction-fit lids or basic screw caps without gaskets allow gradual odor escape despite marketing claims. Evaluate seal quality during wholesale purchasing - inferior sealing represents most common failure point in smell-proof products regardless of wall material quality.

Container Wall Permeability: Material selection affects odor transmission through container walls themselves. Glass provides perfect impermeability preventing any molecular transmission. Dense plastics (HDPE, polypropylene) offer good but imperfect barriers - some odor molecules gradually permeate plastic over hours to days. Thin plastics, cloth, and porous materials allow rapid odor escape regardless of carbon lining or seals. Wall material quality separates effective smell-proof products from marketing claims unsupported by actual performance.

Testing and Verification: Legitimate smell-proof products undergo third-party testing verifying odor containment claims. Request test data or certifications from wholesale suppliers before purchasing. Simple verification involves sealing pungent material in containers then asking untrained individuals (not familiar with product) whether they detect odors - effective containers should be undetectable from 12+ inches distance after 24 hours. Products failing basic testing despite smell-proof marketing create customer dissatisfaction and return headaches better avoided through proper vetting.

Container Types: Material Categories and Applications

Smell-proof storage spans multiple product categories each serving different use cases, price points, and customer preferences. Understanding category distinctions helps dispensaries stock comprehensive selections.

Glass Jars with Airtight Seals: Glass containers with silicone-gasketed lids represent gold standard for smell-proof storage combining perfect odor barrier with humidity control compatibility and premium aesthetics. Quality stash jars wholesale at $3-$8 depending on size and features, retailing at $12.99-$29.99 for 60-70% margins. Glass suits customers prioritizing quality preservation, home storage, and premium presentation. The weight and fragility limit travel applications but glass dominates serious storage for collectors and connoisseurs. Stock 4-6 glass jar sizes from 1/8 ounce to full ounce capacity serving different storage needs.

Metal Tins and Aluminum Containers: Seamless aluminum tins with tight-fitting lids provide excellent odor containment in lightweight, durable packages suitable for travel and daily carry. Metal containers wholesale at $2-$5 and retail at $9.99-$19.99 offering good margins on practical products. The compact form factors fit pockets and bags better than glass while maintaining decent protection. However, metal containers typically lack humidity control integration and can develop odors over time requiring periodic replacement. Position metal tins as portable alternatives to glass for customers needing travel-friendly storage.

Smell-Proof Bags and Pouches: Fabric bags with carbon lining, water-resistant exteriors, and zipper closures create portable smell-proof storage suitable for travel, festivals, and casual transport. Smell-proof bags wholesale at $4-$12 depending on size and features, retailing at $14.99-$34.99. Multiple sizes from small personal pouches to large travel bags serve diverse applications. Premium bags include combination locks, RFID blocking, and organizational compartments adding value beyond smell-proofing. These appeal to younger customers, travelers, and festival attendees prioritizing portability and discretion over preservation features.

Vacuum-Sealed Container Systems: Advanced containers incorporating vacuum pumps remove air creating negative pressure preventing odor escape while dramatically extending flower freshness through oxygen reduction. Vacuum containers wholesale at $8-$20 and retail at $29.99-$69.99 serving serious enthusiasts wanting ultimate preservation. The technology appeals to customers storing valuable flower long-term or building collections requiring optimal preservation. Premium pricing limits market size but exceptional margins and genuine performance benefits justify stocking 2-3 vacuum options for quality-focused customer segments.

Humidity Control Integration: Preserving Quality Beyond Odor Containment

Effective cannabis storage requires managing humidity alongside odor control - dried-out flower loses potency and flavor while over-moist material develops mold. Integrating humidity control separates basic smell-proof products from complete storage solutions.

Ideal Humidity Range for Cannabis Storage: Optimal cannabis storage maintains 55-62% relative humidity preserving trichomes, preventing mold, and maintaining terpene profiles. Below 55% RH, flower dries excessively creating harsh smoke and trichome degradation. Above 65% RH, mold risk increases dramatically. This narrow ideal range requires active humidity management in most environments - ambient room humidity rarely falls within optimal storage range naturally necessitating humidity control products for quality preservation.

Two-Way Humidity Control Packets: Products like Boveda and Integra Boost provide passive humidity regulation absorbing excess moisture or releasing water vapor maintaining stable RH levels. These wholesale at $0.50-$1.50 per packet and retail at $1.99-$4.99 creating excellent margin accessories. Stock multiple RH levels (55%, 58%, 62%) allowing customer selection based on preference - some consumers prefer slightly drier (58%) while others favor moister (62%) flower. Display humidity packets prominently near storage containers suggesting bundled purchases for complete storage solutions.

Hygrometer Integration: Small digital hygrometers displaying current humidity levels inside storage containers help customers monitor storage conditions and verify humidity control effectiveness. Mini hygrometers wholesale at $2-$5 and retail at $9.99-$14.99 as premium accessories for serious storage enthusiasts. Hygrometer-equipped containers wholesale at $6-$12 premiums over basic equivalents but retail pricing sustains 60-70% margins while adding tangible value customers appreciate. Position hygrometer integration as upgrade feature for customers discussing long-term storage or quality preservation.

Container Design for Humidity Control: Storage containers must accommodate humidity control packets without reducing usable capacity excessively. Some premium jars include dedicated packet holders separating humidity control from flower preventing direct contact. Others feature larger capacities accounting for space consumed by humidity packets. When selecting wholesale storage products, verify interior dimensions accommodate both typical quantities and humidity control packets - containers barely fitting 3.5g flower plus humidity packet feel cramped frustrating customers expecting advertised capacity.

Size Selection and Capacity Planning

Storage container sizing significantly affects customer satisfaction and purchase decisions. Understanding capacity needs helps dispensaries stock appropriate size distributions.

Personal Use Sizes (1-3.5 grams): Small containers holding eighth-ounce or less serve daily users storing moderate quantities for personal consumption. These represent highest-velocity storage products - stock 40-50% of storage inventory in personal-use sizes. Wholesale costs run $2-$6 with retail pricing at $9.99-$19.99 creating accessible entry points encouraging storage habit adoption. Position small containers near checkout as impulse purchases and mention during flower sales when customers purchase eighths suggesting proper storage protecting their investment.

Standard Sizes (7-14 grams): Quarter to half-ounce capacity serves moderate users and customers buying larger quantities for extended supply. Stock 30-35% of inventory in standard sizes offering good balance between portability and capacity. These wholesale at $4-$10 and retail at $16.99-$34.99 appealing to established customers moving beyond minimal storage toward quality preservation systems. Recommend standard sizes to customers mentioning buying larger quantities or building small collections of different strains.

Large Storage (28+ grams): Full-ounce and larger containers serve heavy users, collectors maintaining multiple strains, and customers buying bulk for long-term supply. Stock 15-20% of inventory in large capacity serving this segment without overcommitting to slower-moving sizes. Large containers wholesale at $6-$15 and retail at $24.99-$49.99 with good margins on premium products. These often include humidity control integration and premium features justifying higher pricing to serious storage customers.

Multi-Container Systems: Some customers need storing multiple strains separately requiring several containers. Offer multi-packs and storage systems with 3-6 individual containers at bundled pricing encouraging customers building complete storage solutions. Multi-container systems wholesale at $12-$25 and retail at $39.99-$79.99 creating excellent transaction values while serving legitimate customer needs better than single containers. Bundle humidity control packets with multi-container systems for complete turnkey storage solutions.

Material Quality Indicators and Wholesale Evaluation

Storage product quality varies dramatically requiring careful wholesale evaluation preventing stocking inferior products generating returns and customer dissatisfaction.

Seal Quality Testing: Physically test container sealing mechanisms examining gasket quality, lid fit, and closure security. Quality seals feel firm and precise with audible or tactile confirmation of engagement. Loose-fitting lids, gaps in gaskets, or inconsistent sealing across sample units indicate manufacturing quality problems extending to full production batches. Reject suppliers unable to demonstrate consistent seal quality across multiple sample units - sealing represents critical functionality and poor execution creates immediate product failure.

Carbon Lining Verification: Products claiming activated carbon lining should show visible carbon fabric layers when examining interior construction. Some manufacturers falsely claim carbon lining in marketing without actually incorporating carbon materials. Request cutting samples showing interior layer construction verifying carbon presence. Legitimate carbon-lined products also demonstrate measurable weight increases versus non-carbon equivalents - carbon fabric adds noticeable weight absent in fake carbon claims.

Material Thickness and Durability: Examine container wall thickness and material density. Thin plastics crack easily and allow odor permeation. Quality glass containers use thick-wall construction (3mm+ typical) resisting breakage and providing premium feel. Metal containers should employ seamless construction avoiding seams where odors escape. Fabric smell-proof bags need robust water-resistant exteriors and reinforced stitching preventing seam failures after minimal use. Physical durability correlates strongly with overall quality - cheap-feeling products typically perform poorly regardless of marketing claims.

Hardware Quality and Functionality: Evaluate zippers, clasps, locks, and other hardware components for smooth operation and durability. Low-quality zippers jam, break, or allow gaps after limited use cycles. Cheap clasps fail to maintain secure closure or break under normal use. Premium storage products employ branded zippers (YKK, etc.) and quality hardware justifying premium pricing through reliable long-term operation. Hardware quality represents another manufacturing indicator separating quality suppliers from cost-cutting operations producing problematic products.

Legal and Regulatory Considerations for Storage Products

Cannabis storage exists within regulatory frameworks affecting both product design and dispensary sales practices. Understanding compliance requirements prevents legal issues while ensuring customer safety.

Child-Resistant Features and Requirements: Many jurisdictions require child-resistant storage for cannabis products stored in homes with children. Some storage containers incorporate child-resistant features like combination locks, squeeze-and-turn mechanisms, or complex opening sequences meeting regulatory standards. Dispensaries in markets with child-resistant requirements should prominently stock compliant options and educate customers about regulatory obligations. Even in markets without specific mandates, child-resistant storage provides valuable safety features for customers with children justifying premium positioning.

Transportation and Open Container Laws: Cannabis transportation regulations in most jurisdictions require sealed containers preventing access while driving - similar to open container laws for alcohol. Smell-proof storage meeting these requirements creates both compliance and discretion benefits. Educate customers about local transportation laws and position smell-proof storage as legal compliance tools beyond just odor control. This regulatory value proposition strengthens purchase justification particularly for customers frequently transporting cannabis.

Public Consumption and Discretion: While not strictly legal requirements, discretion benefits from smell-proof storage help customers avoid unwanted attention and potential harassment in prohibition or newly-legal markets. Marketing storage products for "discretion" and "privacy" resonates with customers concerned about social stigma or family dynamics around cannabis consumption. This positioning broadens appeal beyond just odor control emphasizing lifestyle and privacy benefits.

Product Labeling and Claims Compliance: Ensure storage product marketing claims don't overstate performance or make unverifiable assertions. "100% smell-proof" represents difficult absolute claim to substantiate while "odor-resistant" or "advanced odor control" more accurately reflect actual performance. Avoid medical or health claims about storage products unless substantiated through testing and regulatory approval. Conservative accurate marketing prevents regulatory scrutiny while building customer trust through realistic expectations.

Merchandising Strategies: Positioning Storage as Essential Systems

Effective storage merchandising requires moving beyond scattered containers toward comprehensive storage solutions positioned as essential components of quality cannabis experiences.

Complete Storage System Displays: Create dedicated storage sections showcasing containers, humidity control, labels, and organizational accessories together as complete systems rather than isolated products. This presentation encourages customers viewing storage comprehensively versus just buying single containers. Include signage like "Complete Flower Preservation System" or "Professional Cannabis Storage Solutions" elevating storage from afterthought to essential equipment. Comprehensive displays also enable cross-selling - customers buying jars add humidity packets, labels, and additional containers when presented as integrated systems.

Flower Purchase Cross-Selling: Train staff to suggest appropriate storage during flower purchases: "Want to keep that eighth fresh? This jar with humidity control maintains perfect moisture and completely contains odor." The suggestion timing leverages customer's flower purchase creating natural storage need awareness. Many customers don't proactively think about storage until prompted - dispensing flower into basic bags represents missed opportunity for accessory sales benefiting both revenue and customer flower quality preservation.

Solution-Based Merchandising: Organize storage displays by use case rather than just product type: "Travel Storage," "Home Preservation," "Collection Management," etc. This organization helps customers identify relevant products matching their specific needs versus browsing generic container selections. Include application photos or illustrations showing products in context - smell-proof bags in backpacks, glass jars in home displays, metal tins in pockets. Visual context helps customers envision use cases driving purchase decisions.

Bundle Pricing and Complete Kits: Create pre-assembled storage kits bundling containers, humidity control packets, and accessories at modest discounts versus individual pricing. "Starter Storage Kit" with small jar, humidity pack, and labels at $19.99 versus $24+ individual pricing creates entry point encouraging storage adoption. "Collector System" with multiple jars, humidity control, and premium case at $89.99 versus $110+ individual pricing serves serious enthusiasts. Bundles increase average transaction values while simplifying purchase decisions through pre-selected combinations.

Price Positioning and Value Communication

Storage products range from $5 budget bags to $100+ premium systems requiring strategic pricing and value justification across tiers.

Entry-Level Accessibility (Under $15): Stock basic smell-proof solutions at $9.99-$14.99 removing price barriers for budget-conscious customers and those trying storage products first time. These entry products rarely achieve premium margins (typically 50-60% versus 65-75% on premium options) but drive category adoption and introduce customers to storage benefits creating upgrade paths. Position entry storage as better-than-nothing starting point while gently suggesting premium alternatives offering enhanced features for modest incremental investment.

Mainstream Quality ($15-$35): Mid-tier storage products combining good performance with reasonable pricing serve majority of customers willing to invest in quality storage without extreme budgets. Glass jars, quality metal containers, and premium bags in this range wholesale at $5-$12 and retail at $19.99-$34.99 offering healthy 60-70% margins on highest-velocity price tier. Emphasize value proposition - "costs less than eighth you're storing while keeping it fresh for weeks" - justifying investment through flower protection benefits.

Premium Performance ($35-$75): High-end storage systems with advanced features like vacuum sealing, integrated hygrometers, premium materials, and superior construction command premium pricing serving quality-focused enthusiasts. These wholesale at $12-$25 and retail at $39.99-$79.99 creating excellent absolute profit per sale ($20-$40 gross profit typical). Justify premium pricing through performance benefits, longevity, and serious collector appeal. Don't apologize for premium pricing - position confidently as optimal solutions for customers refusing compromises on quality preservation.

Ultra-Premium and Luxury ($75+): Exotic materials, designer aesthetics, advanced technology systems, and luxury branding create ultra-premium tier serving affluent consumers and gift buyers. These represent small market segment but exceptional per-unit profits justify stocking 1-2 luxury options testing receptiveness. Luxury storage often emphasizes aesthetics and display value alongside functionality - customers purchasing $150 storage seek statement pieces worthy of visible display not just functional containers hidden in drawers.

Humidity Control Products as Complementary Revenue

Humidity control products create recurring revenue streams and natural upsells during storage container sales significantly improving category profitability beyond just container margins.

Two-Way Humidity Packet Economics: Humidity control packets wholesale at $0.50-$1.50 and retail at $1.99-$4.99 representing 60-75% margins on consumable products requiring periodic replacement. Customers using humidity control typically purchase packets every 2-6 months creating recurring revenue from established customer base. A dispensary selling 100 humidity packets monthly at $2.99 average generates $3,600 annual revenue with $2,200+ gross profit from simple accessory requiring minimal inventory investment or merchandising space.

Packet Size and RH Level Selection: Stock multiple humidity packet sizes (4g, 8g, 67g) and RH levels (55%, 58%, 62%) serving different container capacities and customer preferences. Small packets suit personal-use containers while large packets serve collectors with multiple-ounce storage. RH preferences vary individually - some customers prefer slightly drier while others favor moister flower. Offering choice positions dispensary as sophisticated storage resource versus just stocking generic "humidity control" without specifications.

Education Creating Demand: Many customers don't know humidity control products exist until dispensaries educate them. Simple signage explaining "Maintain optimal 55-62% humidity preserving terpenes and preventing mold" creates awareness and demand. Train staff to mention humidity control during storage sales: "Add humidity packet keeping flower at perfect moisture - they're inexpensive and make noticeable difference in quality preservation." This education builds category awareness converting storage container sales into multi-product purchases.

Bundling and Attachment Rates: Track humidity control attachment rates to storage container sales - sophisticated dispensaries achieve 40-60% attachment meaning nearly half of container buyers add humidity products. Low attachment rates indicate education or positioning gaps. High attachment rates confirm effective cross-selling and customer value communication. Target 50%+ attachment rate through strategic bundling, staff education, and point-of-sale prompting during storage purchases.

Travel and Portable Storage: Specific Use Case Solutions

Travel storage represents distinct category requiring different features and positioning than home preservation products. Understanding travel-specific needs helps dispensaries serve mobile customer segments.

TSA and Air Travel Considerations: While cannabis remains federally illegal making air travel problematic legally, many consumers fly with products anyway. Smell-proof storage provides discretion though not legal protection. Educate customers about legal realities while offering smell-proof bags, metal containers, and discrete solutions for those accepting travel risks. Never explicitly encourage illegal activity but provide tools customers request for travel applications. Some customers also use "travel" storage for legal scenarios like transporting between legal states via car where discretion remains valuable even when legal.

Festival and Event Storage: Music festivals and outdoor events create storage needs balancing portability, security, and discretion. Small smell-proof bags with locking features and water resistance serve these applications excellently. Position these specifically during summer months before major festival seasons creating seasonal demand awareness. Create "Festival Ready" displays bundling portable storage with other event-relevant accessories like compact rolling trays and portable consumption tools.

Daily Carry and Pocket Solutions: Customers taking cannabis to work, friends' houses, or daily activities need pocket-friendly discrete storage. Small metal tins, compact pouches, and slim containers serve daily carry applications. Emphasize size specifications and pocket-ability during merchandising - customers need assurance products fit comfortably in pockets or bags without bulk. Demonstrate pocket fit during sales conversations when customers indicate daily carry as primary use case.

Vehicle and Mobile Storage: Permanent smell-proof storage solutions for vehicles serve customers frequently transporting cannabis. Center console organizers, trunk storage systems, and vehicle-specific solutions create specialized market. While niche category with limited velocity, vehicle storage solutions wholesale at $8-$15 and retail at $29.99-$49.99 generating good margins on specialized products serving real customer needs. Stock 1-2 vehicle storage options testing market interest without excessive inventory commitment.

Conclusion: Storage as Essential Category and Customer Service

Smell-proof storage represents high-margin accessory category delivering genuine customer value through odor control, quality preservation, and discretion benefits essential to modern cannabis consumption. Dispensaries treating storage as essential category - investing in comprehensive selections, educating customers about preservation benefits, integrating humidity control, and merchandising complete storage systems - achieve 15-25% higher accessory category profitability while improving customer satisfaction through better flower preservation and discretion.

Success requires moving beyond commodity container sales toward consultative approach helping customers select appropriate storage matching their specific needs, usage patterns, and priorities. Customers receiving educated storage guidance - explaining humidity control benefits, suggesting appropriate sizes, demonstrating odor containment effectiveness - develop loyalty and view dispensaries as knowledgeable partners in their cannabis experiences versus simple transaction points.

The recurring nature of humidity control products and upgrade paths from basic to premium storage create ongoing revenue opportunities extending beyond initial container purchases. Building systematic storage category management - tracking attachment rates, monitoring inventory velocity by type and size, and continuously educating staff about storage benefits - creates sustainable profit center while genuinely improving customer cannabis experiences through better preservation and discretion.

Ready to elevate your dispensary's storage program with comprehensive smell-proof solutions and preservation systems? Explore MunchMakers' complete storage collections including premium glass jars, smell-proof containers, and humidity control solutions designed for dispensaries building profitable storage categories that serve customer needs while driving accessory revenue growth.